I want to pay my Installers a portion of the Mileage Surcharge we collect. How do I set this up?

Q: We charge our customers a surcharge for some of the distant areas that we service. Our installers use their own vehicles. How do set up our installers to be paid a portion (75%) of what we charge?

A: This can be done easily in SignTraker, and is one of the areas where having a software application do the math grunt work can save you a lot of time and reduce errors at the same time. There are 3 important SignTraker variables involved in calculating mileage payments:

-

The base amount you charge your customer for that Service Area. This is entered as a Mileage Surcharge on your Service Areas screen. You can have a different Mileage Surcharge for every ZIP code you service.

-

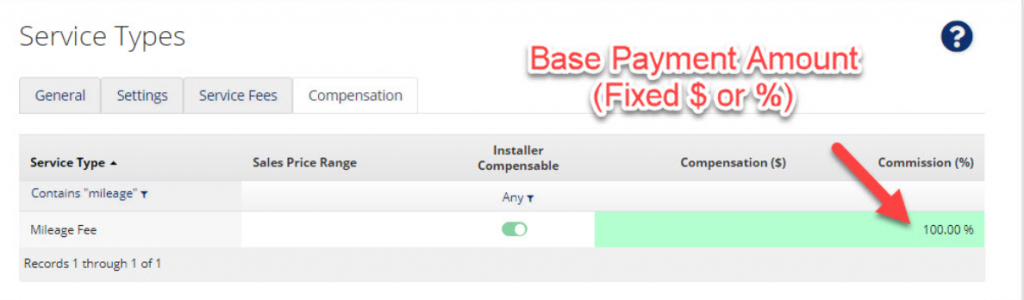

The base payment you want to pass-through to your Installers. This is entered as a flat rate or percentage amount on the Compensation Tab of your Service Types screen.

-

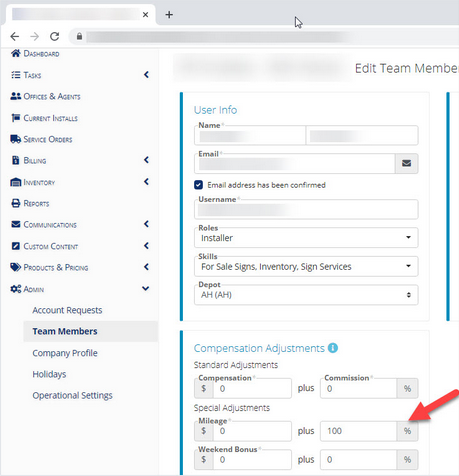

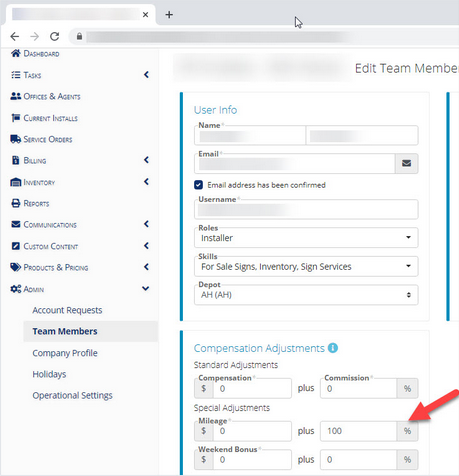

The adjustment (if applicable) due any particular Installer. This is the amount that should be paid above (or below) the base payment amount stipulated on the Compensation Tab. It is entered as a Compensation Adjustment on the Installer’s Profile screen. For example, if one Installer happens to be using a company vehicle, you can reduce the Mileage Surcharge payment to the Installer to $0 (or any other amount) by making the appropriate adjustments in the Installer’s Profile. The Compensation Adjustment can be a fixed amount, or a percentage amount.

Set it up!

-

Express setup: If you think you will be paying all your installers a fixed percentage of the surcharge, like 75%, it is recommended that you (1) set up your Mileage Surcharges normally by ZIP code, and (2) set the base payment amount for the Mileage Fee at 75%. Leave the Installer Adjustments on all Installer Profiles at zero– no adjustments. Then, each installer gets paid whatever amount you put in for the Mileage Surcharge for each Service Area, multiplied by the fixed percentage. Example: If the Mileage Surcharge for a particular ZIP code is $25, then your installer gets 75% of the $25 surcharge, or $18.75.

-

Advanced setup: If you think you’d like to retain a portion of the Mileage Surcharge, pay installers a flat rate for extended trips, pay a flat rate plus a percentage, or pay installers on different scales, then (1) set the Mileage Fee Surcharges in your Service Areas normally, (2) set the default Installer Mileage Compensation to the desired values (for example, $10 plus 50%), and (3) set the appropriate adjustments for each installer using Mileage Surcharge Adjustment screen on each Installer’s Profile. Note that you can choose to place a “global” flat rate on the Mileage Fee (same flat rate for all installers), or set different flat rates per Installer in their individual Profiles.

Other interesting things you can do.

-

Run (and export to Excel®) an Installer Compensation report for any time period you prefer.

-

You can pay mileage on any of the Services you offer (post moves, repairs, rider swaps, etc). Enable the “Installer Compensable” variable on the Services you want to pay mileage on.

-

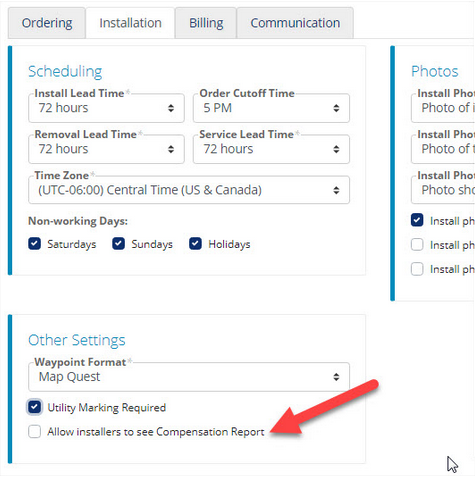

You can enable Installers to see (and download) reports on their mileage and other compensation. Enable the “Allow installers to see Compensation Report” in your Operational Settings screen.

-

You can pay a combination of a flat rate AND a percentage of the Mileage Surcharge. This is useful when the installation location is far away AND there are recurring charges incurred, such as tolls, ferry fees, or other factors to be considered.

By using the Installer Compensation Module, SignTraker can alleviate you, your office staff, or book keeper of the tedium and recurring costs related to manually calculating mileage compensation for your installers– saving time and reducing errors.

Still have a question? Contact live help at 443-938-9178, Opt 1.

Follow SignTraker on Twitter and Facebook @SignTraker

1,576 total views