The Value of Accurate Bookkeeping with QuickBooks

SignTraker gains many new clients among operators ready to expand and grow their business to the next level. One of the most common questions that we get is if bookkeeping, and particularly use of QuickBooks®, is really warranted and worth doing.

The simple answer is YES. As your company grows from being a single proprietor to an organization with multiple vehicles, storage locations, employees, and more, it is more essential than ever to maintain a tight handle on your income, expenses, and profitability. This is where QuickBooks comes in.

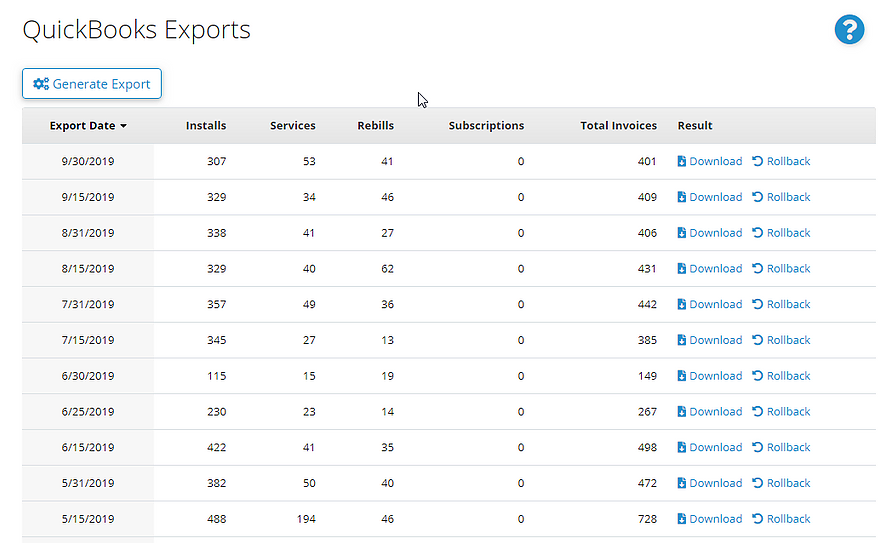

QuickBooks is by far the largest and most widely used accounting system in the United States. Nearly every SignTraker client uses QuickBooks. The reason? Since SignTraker can export all your revenue transactions to QuickBooks, it’s very easy to track your sales (and profit) month to month and quarter to quarter. As real estate installation services are often a seasonal business, being able to track expenses year-over-year as well as comparing quarter to quarter versus prior years is an essential way to make sure you’re staying on track with your business objectives.

-

Tracking income. Each service that you perform in SignTraker, including all installations, service orders, or any other service that you sell or perform in SignTraker for your is automatically transferred to QuickBooks for you. Invoices are completely detailed in every respect, so you can even track profit by item if so desired. You can also keep track of sales and net profit of ancillary services you sell through your SignTraker but that you perform, or subcontract to other providers. This is common when performing or reselling products and services such as photography, home inspections, yard cleanups, sign fabrication, open house signage, and the like.

-

Tracking expenses. Since all your sales are conveniently recorded in QuickBooks from SignTraker, the next objective in making your business more manageable is tracking and accounting for all your expenses. In a sign service business, it is most likely that your employee and staffing expenses are the most significant component of your expense base. Coupled with fuel, rent, insurance, and related overhead items, you can cover the entirety of the expense side of the equation. There are many third- party applications available for QuickBooks to help you track and record expenses. Check out the QuickBooks app store for options for your business.

-

The bottom line: Knowing your financial picture. By having all your income and expenses in one location, you as the business owner and manager can get up-to-the-minute details on the health and profitability of your business. Such data is also essential when expanding your business. For example, when adding new vehicles or space it is often necessary to present your financial details to lenders, leaseholders, and similar interested parties. By having a complete and professionally looking report of your finances and profitability (your balance sheet and profit and loss statements), the likelihood that you will be able to achieve your loan or financing objective is greatly enhanced.

-

Other benefits. Having a good set of books also helps you expand your business to much larger clientele, such as large brokerages or groups of offices that will require you to send them a monthly statement that they can pay once per month. By utilizing the flexible billing capabilities with in SignTraker, and communicating the necessary billing information to QuickBooks, you can keep very tight control of your business’s receivables, knowing who owes you what at any given time. Incidentally, it is not widely known by most business owners, but in fact it is true: having moderate receivables on your books is viewed as a sign of a healthy company. Bankers and investors looking at your books will have a higher confidence in your business knowing that you are sufficiently funded that you can extend credit to your own customers. It makes lenders more likely to extend credit to you.

Managing your business using QuickBooks is a clear sign of business maturity and stability. SignTraker was built to make sure that you can do this easily as your business grows.

If you have any questions on SignTraker’s QuickBooks integration capabilities, please contact SignTraker via our helpline, 443-938-9178 Option 1, or email us.

3,285 total views